Welcome to Part 6 of this multi-part series of blogs where I will teach you a better way to invest in the stock market. But before we dive into the strategies, let’s first address the fundamental question: Why Does The Stock Market Exist?

Come back every fortnight for the next instalment. Or, to ensure that you don’t miss any part of it, subscribe to our blogs to be notified of updates by clicking here: Subscribe to Blogs

If you have missed previous parts, please click on one of the links below to read it:

Read Part 1

Read Part 2

Read Part 3

Read Part 4

Read Part 5

…………………………………………

In Part 5, we reached the end of the section that helps you prepare your mindset for success. The fact that you got this far means you are ready to learn the strategy. From Part 6 onwards, we are going to teach you the strategy. Now, let’s jump into it in detail.

Domestic or Foreign?

Have you heard about the Dow Jones? It’s an index. There’s over 13,000 stocks or shares in the US yet the Dow Jones only makes up the top 30. Overall since 1988, the Dow Jones is going up. Can we generate monthly income off the stock market? Without trying to sound like B.S, yes we can!

Now, let me tell you something. If I said you can apply this strategy on the Australian market and generate a return or you can do it on the US market and double your money, allocating the same time and effort, would you consider the US market? Most people would, some wouldn’t. Those who wouldn’t might have a fear of investing ‘offshore’. They might think that just because they aren’t in the same country as their money, so to speak, they have more chance of losing it. They might think there is no ‘comeback’ if the money is invested overseas and something goes wrong.

These are valid concerns but not ones that actually need to keep anyone from making a good income from this method.

You can lose money just as easily in Australia if you simply gamble and speculate, and there may be little ‘comeback’ if your broker simply disappears or declares bankruptcy. The risks are no higher or lower with the US stock market in that regard. People in Australia when they hear about the US market will tell me they don’t know the US market or the companies. Have you heard of Yahoo, Apple, Microsoft, Google, Caterpillar, Johnson and Johnson, McDonald’s, Walt Disney, Avis Car Rental, Netflix, Paypal, Twitter, Tiffany and Co, Starbucks? They say we know the Australian market, we know Woolies, they are the fresh food people….right?

So if I said to you, you can utilize this phenomenal strategy on the Australian market to earn 1-2% on a monthly basis or, utilize the same strategy with us on the US market, invest the same time and effort, but double your returns, once again, would you consider the US stock market now? Double the returns yet allocating the same time and effort?

How many of you would like to generate an income from the US markets while you sleep and bring it back to Australia? You can.

The beauty about this method is that it works for you while you do something else, even sleeping. We do not stay up at night watching the markets.

The key to long term success and overall greater returns is to be in this for the long haul. That means playing it fair and by the rules because you can’t make money if you are in prison. You can get as rich as you ever want to be legally and ethically and you get to sleep at night. No worrying about a tap on the shoulder or a knock on the door.

“An investment in knowledge always pays the best interest.” – Benjamin Franklin

Before We Go Any Further, Let Me Say A Quick Word About Fokas Beyond

My business, Fokas Beyond, is staffed with professional investors and world strategists with a combined level of experience in excess of 20 years on the stock market. We have a highly respected global financial education. I have personally educated over 30,000 individuals globally on opening their eyes to this strategy and we are the foremost leaders in educating clients to invest with this income strategy right now.

We have members in over 13 countries and we provide the best coaching structure for our members to Learn. Grow. Prosper, Together. Now, let’s look at financial reality. I know I have already said some of this before but bear with me because repetition does not entertain, but it does train and I want to make sure you are on the same page with me.

We’ve been programmed to have one source of income in our lives. A job. J-O-B. If you don’t stop to make plans or goals for your future, you’ll automatically fall into somebody else’s plans. And right now, those somebody else’s plans are your employer’s plans.

You have your J-O-B because your employer needs what you bring to the table; your skills, expertise, experience and even your good name and reputation. Your employer trades off all of that to improve their own bottom line. Along the way, they give you some of the crumbs but rarely any of the cream. You deserve more than that, but you don’t necessarily deserve it for what you do in your J-O-B. You might be very fairly remunerated for your input and productivity, even overcompensated or, you might be getting short-changed. What you need are multiple pillars of income, remember? So why not the stock market and if so, why not the US stock market?

[Article continues after the Masterclass invitation banner below…]

You Can Also Learn this Strategy by attending the “Smart Money” Online Masterclass for Free!

Why Does The Stock Market Exist?

The stock market exists to transfer vast amounts of money from the uneducated to the educated. That’s all it is about. A bit like a casino. They take the money from the punters and they give them a little of it back now and then to keep them coming back for more. Some get more than others and more often, but these are the very few and far between and they are merely bait to lure in the great unwashed. Unwashed, uneducated, but cashed up.

The stock market is more subtle than a casino, but most gamble their money away there, anyway. Most investors are gamblers, speculators who are guessing the stock will go up or down and by how much.

So in regards to the stock market, or my stock market secret, I simply do the exact polar opposite of what 95% of people do. 95% of people will follow the herd. I do the exact polar opposite. And that’s why I’m here and that’s why I’m where I am right now, because of that fact.

“The ultimate ignorance is the rejection of something you know nothing about and refuse to investigate.” – Dr. Wayne Dyer

Welcome to Fokas Beyond Covered Calls

So what exactly are Covered Calls. In the simplest of terms, present here in ‘bullet point’ form, are the details:

- We purchase stocks on the US stock market in lots of 100.

- We can now create an option against the stock for income upfront into our trading account the next trading day.

- The option contract we create is very precise. It has an agreed price that we agree to sell the stock at and an expiry date where the contract no longer has value.

- We write Option contracts on stocks we own for traders/speculators who purchase our contracts in the hope that they will rise in price and thus make a profit.

- The buyer of our contract agrees to purchase our stock at an agreed price called a Strike Price.

- Global Investors trade the US stock market every day and they will continue to do so as they have done for decades, even centuries.

- The contract created has an expiry date, which is always the third Friday of every month.

- This allows us to generate an income of between 1.5% – 4% approximately a month irrespective of stock market direction.

There are millions of option buyers in the stock market trading options in the hope to make money. In fact, an average of 30 million contracts are traded per day. Think about that. Do you think we will have a problem finding a buyer when 30 million contracts are traded per day on average. We create these option contracts and sell them to the buyers and for this, we generate a return upfront irrespective of what the stock market or stock will do. Our profit is made the moment they buy the Option. And the money is in our account by the next trading day. We then sit and wait until the third Friday of the month to see whether the stock closes above the Strike Price or below.

If the stock makes strike and closes above the agreed price, then we sell the stock to the option buyer, we receive back into our account the agreed price that we sold the stock for, plus the income we generated from Day 1 and then use the money and the profit to buy new stock which we then write an Option on and sell that to another speculator, banking the income from that transaction, our profit, the very next trading day. Then we wait until the third Friday of the month and the cycle begins again. Straight forward.

When I say, ‘write an Option’, it’s not like you have to handwrite the contract yourself. We use online brokers to implement this for us through their platforms and just change the relevant details like stock name, prices and so on. It is a few keystrokes on a computer kind of writing.

Like I say, 10 clicks in 10 minutes and once your order goes into the market, you have generated your income.

If the stock doesn’t make strike at the end of the month, then we keep the stock and remember, the premium originally received, then we are free to sell an Option on the existing stock again the very next trading day. Saves us a brokerage fee having to buy new stock!

The speculator who bought our Option contract might not, and usually will not, hold onto the Option until the third Friday in the month. They will sell it to someone for a profit or loss depending on what the stock does during the month, then look for new Option contracts to purchase.

The buyer of our Option will quite likely sell it on themselves and this will go on throughout the month until the third Friday. This is where the real gamblers might step in and try to make the big killing. It can also be where the newbies get cleaned out! You, meanwhile, don’t have a care in the world because whether the stock makes strike, goes beyond or falls well below, you have made your income and cashflow already from day 1.

The Stock Value Falls – Now What?

If the stock you hold falls and doesn’t make strike then the Option buyer doesn’t have to buy the stock. Yes, you now have 100 shares of a stock that is worth possibly much less than what you originally bought it for but we cover ourselves against that being a catastrophic loss simply by buying blue-chip stocks. We don’t buy stock that we suspect might fall beyond a few dollars or so. Of course, crashes happen, but that is why the right education, our education includes discovering how to read the market trends and select the better stocks. No guarantees but we can minimise the risk considerably through applying the education we offer.

Worst case scenario you have 100 shares of stock that, in time, will not only claw back whatever was lost but, if the last 100 years of trading is anything to go by and it is, they will increase in value. You only lose money if you sell the stock for less than you bought it for and even then, depending on how much it made for you from the covered calls while you owned it, you could still be in front.

Let’s Look At An Example

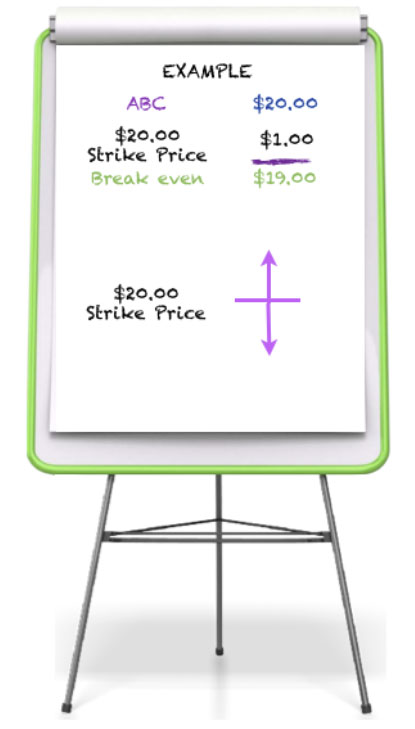

We will call a Stock ABC, and we need to create an Option contract at an agreed price, called a Strike Price. This means that we agree as owners of the stock to sell the stock at a future date, at the agreed price. If the stock reaches the agreed price it is known as ‘making strike’. The ‘future date’ on the US market is always the third Friday of each month.

ABC is trading at $20.00

We will create an Option at a Strike Price of $20.00. The buyer of our option is willing to pay us $1.00 per share for the right to be able to buy our stock from today, till the third Friday at the agreed price of $20 per share.

Two things can happen at the end of the contract period. The stock will either close above the $20.00 agreed price or below.

Two things can happen at the end of the contract period. The stock will either close above the $20.00 agreed price or below.

What the buyer agrees to is this: if, at the end of the contract period, the stock closes at or above the Strike Price, they are happy to buy the stock from us at the agreed price. So if ABC closes at $20.25, the buyer takes the stock from us and pays us $20.00 per stock as per the agreed contract in place. Even if the stock closes at $20.00 or $20.01, the buyer must take the stock from us and pay us back $20.00 per stock. This is done automatically by the broker and we don’t need to do anything at the end of the month, it’s all done for us.

If the stock closes below the agreed price, (the Strike Price 19.99 or lower) on expiry, the contract expires worthless. We keep the stock, we keep the premium that was paid to us from Day 1 ($1 per share so $100 in total) and we now create a new contract for the next month on the same stock that we hold.

It’s that simple. At the end of the month, the stock will either close above or below the agreed Strike Price. We will either sell the stock at the end of the month or hold it. We will either create a new contract on existing stock we own and hold, or create a new contract on new stock we purchase if we were ‘exercised’.

Exercised means, the stock is taken from us and handed over to the option buyer.

Looking at the example above, if the option buyer pays me upfront $1.00 per share in income, what is my break-even? I purchase the stock for $20 and receive $1.00 in income, my breakeven is $19.00. This means we have purchased a stock at a discounted price compared to the average speculator who purchases stocks on the market at retail. It is the discounted price that banks and stockbrokers pay nearly every time they go into the market. You are now playing the same game.

We now have a $1.00 buffer on our capital to allow the stock to move and still be in profit.

So if this stock during the month drops down to $19, I am still ahead or at the very least, I have not lost any money because I can sell the stock at $19 and I still have the $1 per share paid for the Option, so I end up with the same $20 per share I started with. Hence, I ‘break even’.

Let’s look at the downside. At the end of the month, let’s say my stock that I bought has now closed at $18.50. This is now below my break even. Have I lost anything? No, because I haven’t sold the stock. I still have the $1.00 paid to me which is liquid, physical cash, income. After expiry, being the third Friday, what do I do on a stock that has dropped? I go back into the stock market on Monday and create another contract for the new month, earning us another income irrespective of the price of the stock.

What you need to understand is this; because the stock has closed on expiry at $18.50, it does not automatically mean that during the next month’s contracts the stock will go below this price. It could go up. It could go down. It could stay the same. Do we know what the stock will do? NO. Did we receive an income in the first month? YES. Do we receive an income now in the second month from creating a new contract even when the stock is now at $18.50? Absolutely. We cannot predict what the stock and the market will do, I’m not here to tell you I can predict, I can’t. All I know is I can earn income from the stock irrespective which way it will trade during the month. Some will say where do you create the next months contract if the stock is $18.50. In our education, we have a formula that I have been applying since 1999 that I provide to my members all around the world. So we want to create a new contract, we apply the formula to earn more income even if the stock is below the $19 break-even cost that we have. It’s Brilliant.

This Is Not Guessing, Gambling Or Speculating!

Stocks fluctuate every day, they go up and down, and as we don’t trade direction we are not guessing where they will be at the end of the contract. We are not gambling whether they will be up or down on the third Friday of the month. We are not speculating that we can make a killing… or not. We are looking at the income potential of the stock because we let the stock market do what it wants to every day.

In essence, the strategy is very straightforward with great opportunities. The best part about this strategy is that you can get into the market utilizing our phenomenal strategy with as little as $2,000 – $5,000 USD in the case of our example where ABC Stock is selling at $20 a share (plus brokerage fees). The return of 2% or 4% is the same whether you buy $2,000, $20,000, or $200,000.

Our ABC Stock made us 5% on our investment. (5% of $20 is $1). Had we bought $200,000 of stock, or twenty contracts of 100 shares per contract, we would still have made 5%, which is $10,000.

Think about the potential this has for you if you really stepped up and took action and believed in yourself.

But if I said to you right now, with $2,000, let’s get into the market, get your feet wet and discover the strategy, build a solid foundation and build your knowledge so that you could build your skyscraper… this would certainly be of interest to you.

If you had $10,000 and you potentially earned yourself a 3% return, that’s $300 a month. Now, we’ve got to take brokerage out, as this is a cost of doing business, however, brokerage is only a small fee per transaction of $15 USD to buy the stock and $10 to create the contract minimum. Let’s just say $300 a month. Can that potentially help you pay off your home loan quicker or help build a property portfolio? Absolutely it can! It’s not going to make you rich, allow you to retire in a years time or double your money. I’m not here to make these claims, it’s not possible. I’m here to educate you on how to earn a small return upfront on your capital from the stock market irrespective of the stock markets movements during the month. As I say, slow and steady wins the race. It is a 3 – 5 year plan.

…………………………………………

Can you see the potential of the stock investment strategy that I have just presented you with above? Let me go into even more detail and examples in the next blog to help you understand it better.

Click here to read Part 7 now.